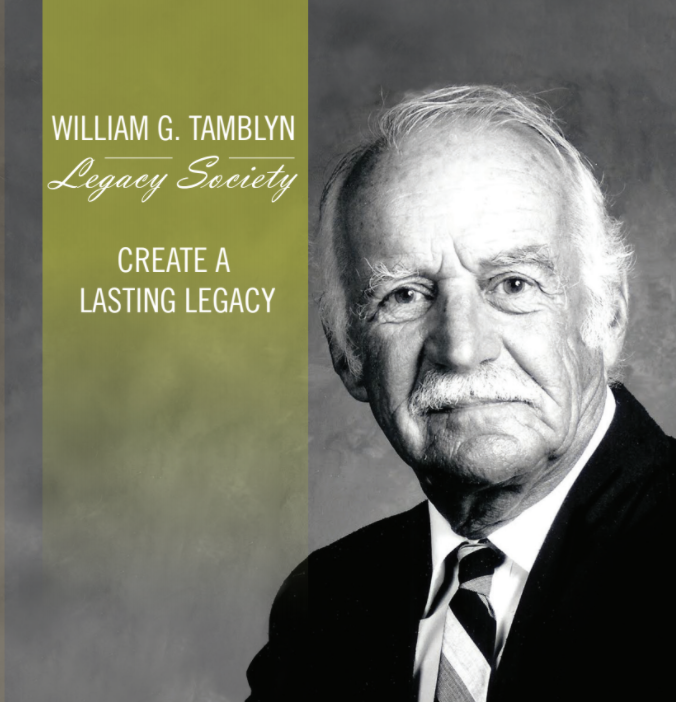

William G. Tamblyn Legacy Society

Established in 2015 to recognize the founding president and vice- chancellor for his vision, exemplary leadership and contributions to the early development of Lakehead University, the William G. Tamblyn Legacy Society brings a new opportunity to recognize those who share the common goal of ensuring the stability and future sustainability of Lakehead University. Benefits of membership include invitation to events, presentations and seminars.

Define Your Legacy. Determine Your Strategy.

A Gift in Your Will

Name Lakehead University as a beneficiary in your Will. Gifts can be a specific dollar amount, asset, percent or residue of your estate and tailored to a specific.

Gifts of Life Insurance

Designate Lakehead University as the beneficiary of an insurance policy. If the policy is owned by the University, the donor receives a tax receipt for each premium paid. If the donor retains ownership of the policy, the death benefit that is paid to the University is eligible for a tax receipt.

Gifts of RRSPs/RRIFs

Designate Lakehead University as the beneficiary of a qualified retirement plan. Your estate will receive a tax receipt for the full value of the assets and significantly decrease or eliminate the estate tax burden.

For all legacy inquiries, please contact:

Jennifer McKeown, Development Officer

Phone: 807-343-8010 ext. 7792

Email: jennifer.mckeown@lakeheadu.ca